If you have an FSA, chances are you just had to use it or lose it before tax season was up. If you have an HSA, chances are you have no idea why anyone would put money into an account that they couldn’t get back.

So, what’s the difference? Should you get an HSA or FSA?

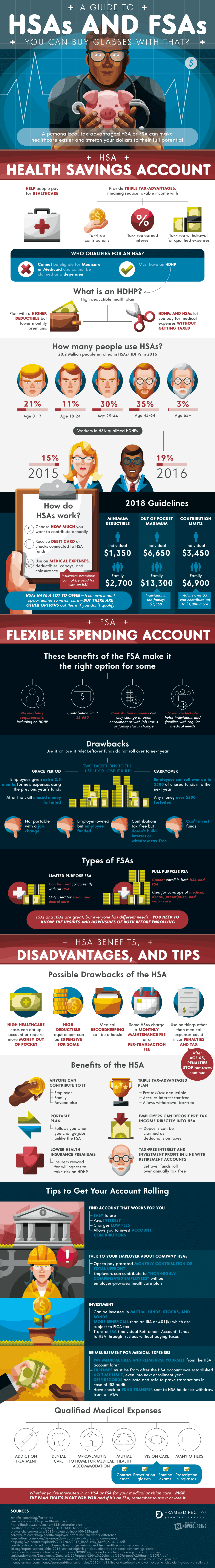

About FSA

FSAs are incredibly common since anyone can qualify for them. They can help you save money on your taxes by taking money out of your paycheck pre-tax so you can spend them on qualified healthcare expenditures.

You have to spend 7.5% of your annual income in order to be able to deduct your medical expenses from your tax bill otherwise- that is if you are itemizing at all.

Taking the money out pre-tax to pay for these things can save you the stress of doing additional paperwork. They can also help you save hundreds of dollars on your tax bill, too.

Unfortunately, you have to be pretty certain how much you plan to spend on healthcare in a given year. You can’t change that amount after the start of the calendar year. If you get a cancer diagnosis in February, there’s no way to go back and add more to the account.

The amount you can contribute without paying tax is only $2650. If you do end up spending 7.5% or more of your income on healthcare expenses, you could end up paying more taxes than if you had not used an FSA at all.

Your FSA covers things like medical, dental, and vision exams. It can also include glasses, prescriptions, many medical devices, addiction treatment, and more.

About HSA

HSAs, on the other hand, allow you to deposit $3400 per person or $6750 per family per year. If you are over the age of 55, you can add $1000 a year to that. That money rolls over in perpetuity for the rest of your life, even earning interest in certain accounts.

You can continue to accrue money to use toward your elder and end of life care. When you die, that money either rolls over to your spouse or becomes part of your estate, which is taxable at that point.

Unfortunately, only about 19% of Americans can qualify for this type of account. You must have a high deductible health plan in order to qualify to put money into an HSA, though you can still use the money in your HSA if you get different insurance.

An HSA covers all the same basic things that are covered by an FSA. However, the advantages of being able to roll that money over in perpetuity and the fact that anyone can contribute to the account make this type of account very appealing to those who qualify.

How Many People Use These Accounts?

Because so few people have high deductible health plans or HDHPs, only about 19% of Americans are currently enrolled in an HSA account. FSA plans, however, are a little more common.

According to The Street:

- Around 20% of employees sign up for FSAs

- Many don’t fund them or fund them very little because they are afraid of losing their money

- You can only roll over $500 at the end of the year, which is a fairly new provision

- 85% of large companies offer an FSA as part of their benefits package

- 62% of small to medium businesses offer an FSA

Making The Most Of Either Account

In order to get your money’s worth from an FSA, you should tally up your expected medical expenses for the year and contribute that amount or up to $500 more than that. Keep careful track of your expenses and be sure you are being reimbursed.

If you have an HSA, you can start saving for your senior healthcare needs now.

With a properly managed FSA or HSA, you could save hundreds of dollars on your tax bill every year. Learn more about the differences between HSAs and FSAs from this infographic.

The post HSA or FSA: Which One Do You Really Need To Maximize Your Savings? appeared first on Dumb Little Man.

from

https://www.dumblittleman.com/hsa-or-fsa/

No comments:

Post a Comment