Every STARTplanner has pages for planning your annual budget and savings under the goals tab, we know that things change in a year, but having a vision of where you want to be headed can make a big difference when you are working towards a goal like vacation, retirement or a new home!

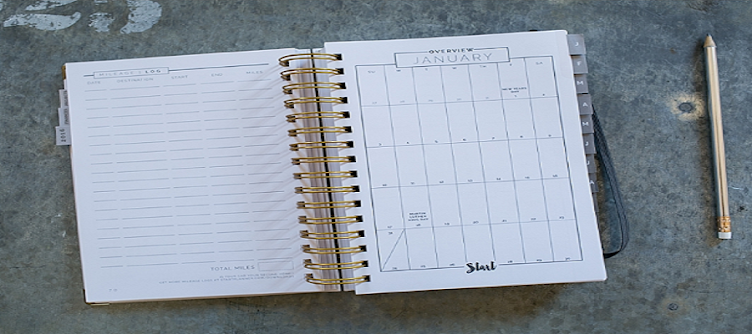

Once you have your year overview, we break it down into months, so you can record all your expenses and know what your monthly cash flow will be so that you can be sure that it is aligning with your annual goals!

Each day has a space to record daily costs of eating out to keep you aware of all those “littles” costs that add up so fast! (it can add up SO fast and really derail your goals of savings quickly, unless you budget for it appropriately!)

Buying a car? Saving for college? Under the goals tab, we also have pages where you can write your specific goals, plan out action steps that will get you there and set accountability partners.

Once you know what your bigger goals are, you can take those action steps and translate them to the mini-goals at the beginning of each month to help keep you mindful of what you are working towards.

We ALWAYS encourage you (and there is space to write it down!) to pick an accountability partner! This is someone who encourages you to stay on track with your goals, helps you find your way if you have lost motivation and someone to answer to if you feel like giving up! This person should be someone who isn’t afraid to push you when the going gets tough!

Write down in your planner what days you will sit down and pay your bills…and then DO IT! It is so easy in the hustle and bustle to forget a due date but if you sit down once or twice a month and pay for all bills in the next cycle all at once, it makes it much easier to be assured it has all been taken care of! (and late fees are such a waste! We would much rather earmark that money for something fun, wouldn’t you?!)

By managing your time better on our daily and weekly schedules, keeping on a schedule and blocking your like-items together for efficiency, you could open up pockets of time for a side hustle!

We have all been guilty of it… ok, ok, at least I know I have… going to the store for one thing and leaving with a $250 receipt (I swear, the chips on the endcap were BEGGING to come home with me!) But by using the meal planning /grocery list (available in Fancy Pants and Hustle Daily) and then STICKING TO the items on the list (Yes, we know it is easier said than done, but you can do it!) you can save yourself from those extra grocery impulse purchases as well as buying food that you really don’t need or already have!

What?! Money Trees don’t exist? 😜 yes…. sadly we know, BUT you can still use the daily to-dos and notes section to keep track of those things that you need to do to keep your goals moving forward and to write yourself little motivational messages to “keep going!”… by using all the tips here in you STARTplanner, you could even save enough money that you FEEL like you found a money tree!

from STARTplanner - News https://startplanner.com/blogs/news/6-tips-for-using-your-planner-to-organize-your-finances

from

https://startplanner.tumblr.com/post/178979071173

No comments:

Post a Comment